RATES FOR CORPORATES AND FIRMS

The Finance (No. 2) Bill, 2024 (Bill) does not propose any change in the tax rates for domestic companies and firms under the Income-tax Act, 1961 (IT Act). The base tax rates are listed below for ready reference:

- Domestic companies: 15% / 22% / 25% / 30%, depending on factors such as nature of business, commencement of operations, turnover thresholds, optional concessional tax regime, etc

- Partnerships and LLPs: 30%

Surcharge on base rates, too, remain unchanged for these entities.

Reduction in tax rate for foreign companies

The Bill proposes to reduce the base corporate tax rate from 40% to 35% (special rates for specified income streams such as interest, fees for technical services, capital gains, and dividends in specified circumstances shall continue to apply). There has been no change proposed in the surcharge rates.

Rates for individuals and other non-corporate entities

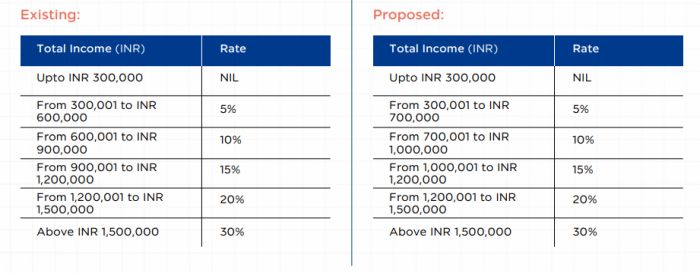

Currently, all individuals (resident/non-resident) and Hindu Undivided Families (HUFs) are taxed as per progressive slab rates ranging between 0% and 30% (except special rates for specified incomes). In addition to the base tax, surcharge (ranging from 10% to 37%) is also applicable. Notably, there are two tax regimes, being 'old regime' and the 'new regime', with different mechanisms for computing income and tax thereon. There is no change in the tax rates for 'old regime'. The Bill proposes the following change in the slab rates under the 'new regime':

Further, there has been a substantial overhaul in the capital gains tax regime (tax rates, period of holding, indexation, etc.) for all taxpayers (residents and non-resident); these are separately discussed in subsequent sections of this Ergo.

OVERHAUL OF CAPITAL GAINS TAX REGIME

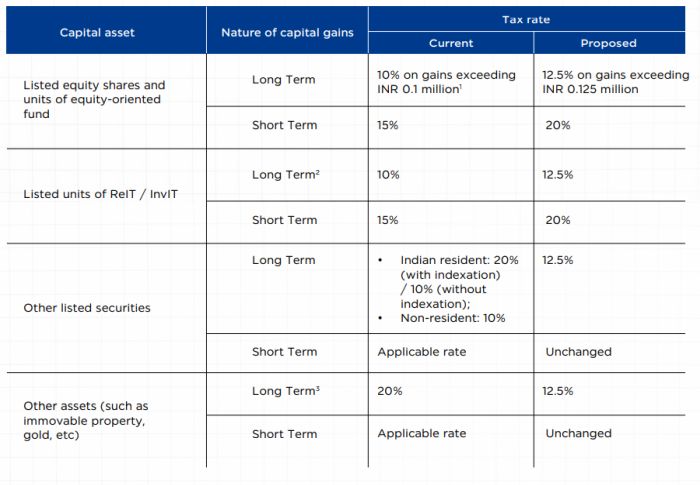

In order to simplify and rationalize the capital gains tax regime, the Bill proposes to amend (with effect from 23 July 2024) the holding period as well as tax rates as set out below:

Indexation benefit no longer available

With the rationalisation of the long-term capital gains tax rate to 12.5%, the benefit of indexation is proposed to be removed for calculation of any long-term capital gains which is currently available for long-term capital assets (such as unlisted securities, immovable property and gold).

The overhaul aims to significantly streamline the capital gains provisions across investor class and asset class. From the perspective of cost adjustment on long term assets such as immoveable property, the abolishment of indexation of cost could potentially result in higher capital gains outflow (depending on factors such as original cost of acquisition and holding period).

This amendment is proposed to be effective from 23 July 2024.

Taxation of debt instruments

- Specified Mutual Fund | Clearing the Greys

Section 50AA of the IT Act deems income arising on transfer or redemption or maturity of units of 'Specified Mutual Fund' as short-term capital gains. 'Specified Mutual Fund' is defined to mean any mutual fund, where not more than 35% of its total proceeds is invested in the equity shares of domestic companies. This created an ambiguity on applicability of Section 50AA to other non-debt funds as well as fund of funds. The Bill proposes to amend the definition of 'Specified Mutual Fund' to mean (i) mutual fund which invests more than 65% of its total proceeds in debt and money market instruments, and (ii) a fund which invests 65% of its total proceeds in the foregoing mutual fund. It is also proposed that the debt and money market instruments shall include securities classified or regulated by Securities and Exchange Board of India, which indicates that applicability of Section 50AA should be limited to India focused funds.

This amendment is proposed to be effective for FY 2025-26 and onwards.

- Unlisted Bonds and Debentures | Short Term Capital Gains

Noting that unlisted bonds and debentures are debt instruments, the Bill proposes to include unlisted bonds and debentures within the ambit of Section 50AA and tax the income arising on transfer or redemption thereof as shortterm capital gains regardless of the period of holding. Having said that, foreign investors may assess to claim the benefit (if any) on such capital gains under an applicable tax treaty.

This amendment is proposed to be effective from 23 July 2024.

To view the full article click here

Footnotes

1. Resident investors selling listed equity shares off-market shall be taxed at 20% (with indexation) or at 10% (without indexation)

2. Holding period for units of ReIT /InvIT to qualify as long-term capital asset proposed to be reduced from 36 months to 12 months

3. Holding period for other assets (other than slump sale transactions) to qualify as long-term capital asset proposed to be reduced from 36 months to 24 months

The content of this document do not necessarily reflect the views/position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up please contact Khaitan & Co at legalalerts@khaitanco.com